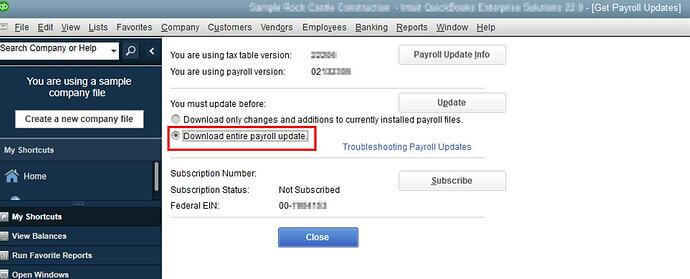

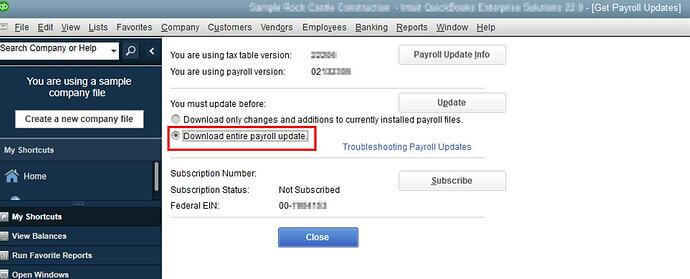

This article explains how to get the most recent payroll tax table in QuickBooks Desktop Payroll in order to maintain compliance with paycheck computations.

You need to currently be subscribed to QuickBooks Desktop Payroll in order to change your tax table.

Learn how to do QuickBooks Payroll update and install QuickBooks Desktop’s most recent tax table by following the below steps:

Benefits:

Here’re the 2 benefits of doing QuickBooks Payroll update:

Conclusion:

By conducting frequent QuickBooks Payroll updates, you can maintain payroll compliance, precise calculations, timely tax filings, and access to the newest features and upgrades. This helps you handle your payroll more efficiently, avoid mistakes, and keep correct financial records, thereby saving time and costs while complying with payroll rules.

If you’re still having trouble doing QuickBooks Payroll update and need more help, feel free to contact us at +1-855-223-4887 .